Customer Lifetime Value (CLV) is a crucial metric for understanding your customer base and their value to your business. It plays a significant role in developing personalized strategies that focus on maximizing value by identifying and investing in high-CLV customers. Pioneers like Peter Fader and Dan McCarthy have demonstrated the power of prioritizing customer value through customer-centric approaches, which can lead to long-term success.

However, CLV has potential uses beyond personalized marketing and strategic resource allocation. At the company level, calculating Average CLV (aCLV) can provide invaluable insights into a business’s operations. While it may not inform decisions about individual customers, it serves as a valuable tool for evaluating the overall health and strategy of a company.

Additionally, the necessary data for computing aCLV is often easily obtainable, making it an accessible calculation for analysts.

Unlocking Insights with aCLV

Determining aCLV involves more than just crunching numbers; it provides insight into the financial workings of a company and how it interacts with its customers. By analyzing the different aspects of aCLV, analysts can connect operational data to strategic opportunities and challenges.

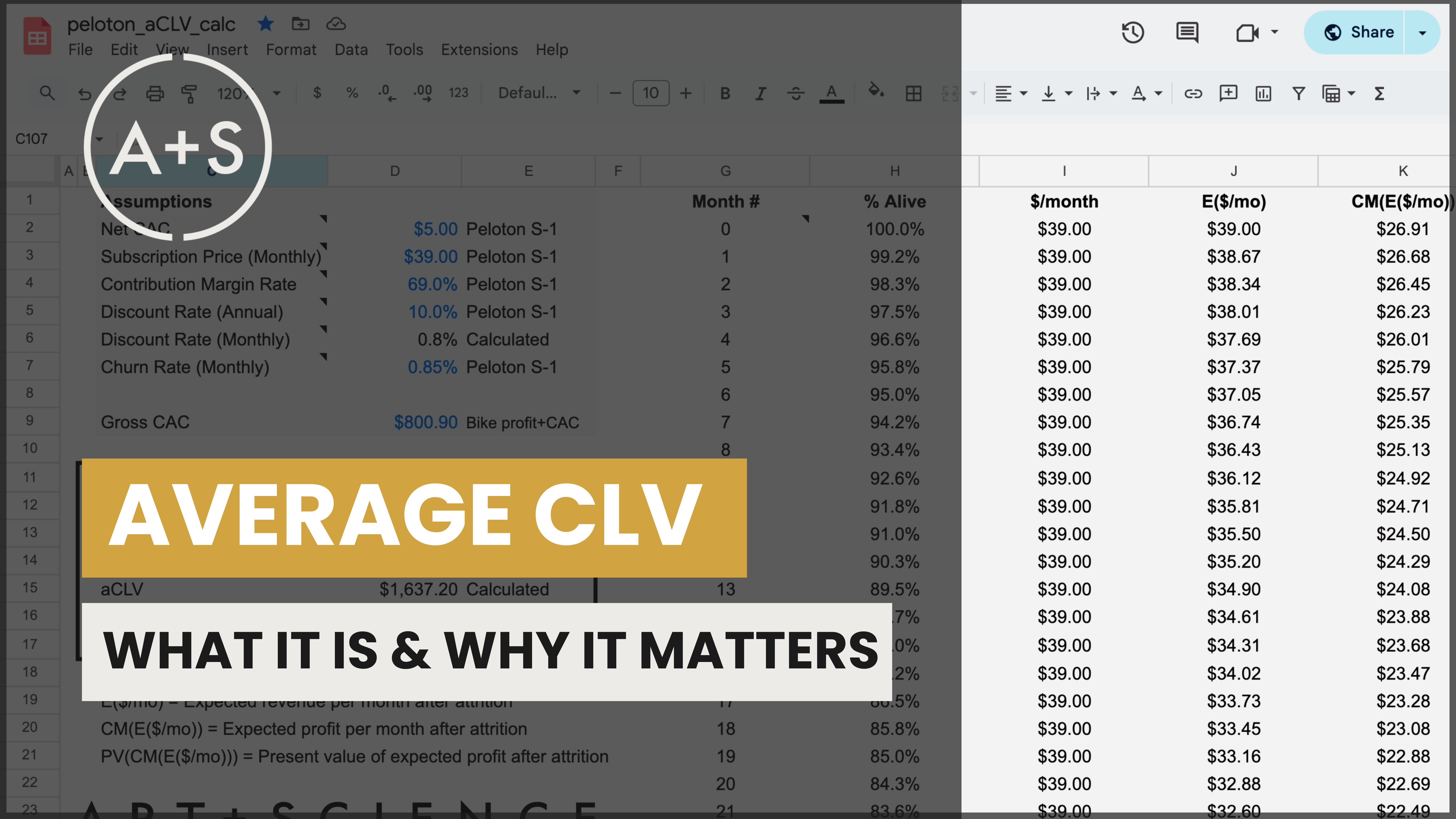

At its core, the formula for aCLV is simple. Five important variables must be collected, regardless of analysis setting:

Customer Acquisition Costs (CAC): The overall cost of gaining a new customer, encompassing all expenses related to marketing and sales. This usually includes costs for advertising, salaries of sales and marketing personnel, and other associated costs.

Churn Rate (Monthly): The rate at which customers end their relationship with a company in a particular month. This metric is crucial for determining customer retention and provides insight into the overall state of the customer base. It is most easily observable for subscription-based businesses (i.e., when a customer cancels their service).

Average Revenue (Monthly): The amount of money a customer generates on a monthly basis is known as the average revenue. For subscription-based services, this is a simple calculation and is usually paid on a monthly basis. This type of revenue provides a steady stream of income for the company that offers the subscription.

Contribution Margin: The portion of each sale that contributes to covering fixed costs and generating profit is known as the contribution margin. This is calculated by subtracting the variable costs, or Cost of Goods Sold (COGS), from the sales price and then dividing by the sales price. It is also referred to as Gross Margin.

Discount Rate: The rate of return that an investment in similar risk markets could earn. This rate is used to calculate the present value of future cash flows. The firm’s Weighted Average Cost of Capital (WACC) is often used as the rate in CLV calculations.

Using these measurements, you can determine the current worth of expected profit after accounting for attrition in a given month and forecast those numbers into the future. Add together the discounted monthly profits throughout the duration of a customer’s relationship with your business, subtract the CAC associated with acquiring a customer, and what you have left is the aCLV.

I have linked here a Google Sheets spreadsheet here that you can use to calculate aCLV for any company once you have gathered the required data. Note that you’ll need to make a copy of it before you can edit the spreadsheet (go to File > Make a copy). Look for a video later this week on our Art+Science YouTube Channel that will guide you through the process of using it.

The metrics you’ll need to complete the aCLV calculation — namely CAC, Churn Rate, Average Revenue, Contribution Margin, and Discount Rate — can typically be found in a company’s financial statements, investor reports, earnings calls, and other supplemental materials. Third-party tools and analyst reports may also provide useful information. To make things easier for you, I have compiled a list of these metrics and their corresponding sources in a separate tab of the Google Sheets file.

Calculating aCLV provides valuable insights into the current value of a customer for any company, whether it’s your own business, one you’re considering purchasing, or a competitor. With this data, aCLV becomes more than just a numerical value; it becomes a tool to analyze the financial foundation of customer relationships and assess strategic choices.

Key Applications of aCLV

Whether it’s evaluating financial soundness, enhancing acquisition and retention tactics, or discovering potential avenues for growth, the uses of aCLV go beyond mere quantification. Here are four ways companies and analysts can utilize this metric to generate valuable insights.

1. Evaluating Business Health and Sustainability

aCLV serves as a financial barometer, providing valuable information on a company’s ability to generate profits from its customer base. A higher aCLV suggests strong customer loyalty and profitability, while a lower aCLV may indicate potential issues with customer acquisition, retention, or service quality. Analysts can utilize this data to pinpoint areas for improvement in operations that could result in increased value for the company.

2. Balancing Acquisition and Retention Strategies

One important application of aCLV is evaluating the ratio of CLV to Customer Acquisition Cost (CAC). Companies that are performing well typically strive for a CLV:CAC ratio of at least 3:1, indicating that the value gained from customers comfortably surpasses the variable costs of the products they buy and the costs of acquiring them. If CAC starts to get near or even exceed CLV, it serves as a warning sign of ineffective marketing or sales methods. Analysts may suggest adjusting strategies to focus more on retention rather than acquisition, or shifting marketing spend to more efficient channels in order to achieve maximum return on investment.

3. Assessing Retention as a Lever for Growth

Customer retention is a crucial factor in determining the lifetime value of a customer. Even small improvements in retention, such as reducing churn rates, can greatly impact the overall value of a customer. Analysts play a key role in advising organizations on investing in loyalty programs, improving onboarding processes, and offering personalized support to increase customer lifetimes and drive sustainable growth.

4. Forecasting and Financial Planning

aCLV is a crucial factor in determining revenue projections and valuation models. By multiplying aCLV by the total number of active customers, businesses can gain valuable insight into their expected lifetime revenue. This information is incredibly useful for budgeting, financial predictions, and strategic decision-making, as it directly connects customer relationships to long-term growth.

For analysts, mastering the concept of aCLV goes beyond simply crunching numbers; it involves crafting compelling stories that link customer actions to tangible business results. Put simply, aCLV provides the clarity necessary to turn observations into effective strategies.

Connecting the Dots

Although aCLV is not specifically focused on targeting individuals, its importance should not be underestimated. By comprehending aCLV, you gain a high-level understanding of a company’s customer value and strategies. Being able to precisely measure and utilize this understanding is crucial.

Whether you’re evaluating your own processes, considering the purchase of a company, or analyzing competitors, understanding the aCLV can provide valuable insights into business strategies and help organizations thrive in an increasingly customer-focused market.

As analysts, our ability to quantify and interpret customer value can shape the strategies that drive long-term success. By mastering aCLV, we unlock a powerful tool for business storytelling and strategic impact.