In this edition of “My Favorite Analyses” series by exploring Customer Lifetime Value (CLV). CLV is a key factor in understanding the overall value of a customer throughout their entire relationship with a business. By accurately determining CLV, companies can make better decisions when it comes to acquiring, retaining, and investing in customers.

We will briefly discuss CLV and provide you with links to an R script that you can use to calculate it on your own (as well as a practice dataset).

What is CLV?

CLV is the net present value (NPV) of all variable profits and costs associated with a customer over their entire relationship with a company. It is the ultimate measure of a customer’s worth to a businesses. CLV not only takes into account the loyalty and potential for future business from a customer, but also the resources and efforts put into acquiring them in the first place.

Accurately calculating CLV is crucial for businesses to make informed decisions about how to acquire and retain customers. By understanding the true value of each customer, companies can tailor their efforts to maximize profits and build lasting relationships with their most valuable clients.

The three main components that make up CLV are:

-

Historical Value (HV): The NPV of all past variable profits, relative to today. HV is not generally useful on its own, but it is an important component of CLV.

-

Residual Lifetime Value (RLV): The NPV of all future variable profits, relative to today. RLV is essential in determining the future growth potential of your customer base. This is a crucial metric when deciding where to concentrate retention efforts.

-

Post-Acquisition Value (PAV): The concept of PAV is the sum of HV and RLV, offering a comprehensive view of a customer’s value after acquisition. PAV assists a company in determining the maximum amount to invest in its customer acquisition costs (CAC.)

Put simply, CLV is calculated by subtracting the NPV of CAC from PAV.

What is CAC?

CAC is the NPV of the overall expense a company incurs to gain a new customer. This includes all costs related to attracting, converting, and onboarding a customer, which usually involves marketing and sales expenditures.

The components of CAC include:

-

Marketing Expenses: This includes all costs related to marketing campaigns, advertising, promotions, and other activities aimed at attracting potential customers.

-

Sales Expenses: Costs associated with the sales process, such as salaries and commissions of the sales team, tools, and technologies used for sales activities, and other related expenses.

-

Onboarding Costs: Expenses incurred during the customer onboarding process, including costs for customer support, training, and any initial setup required to start using the product or service.

Typically, CAC falls within the range of 5% to 15% of a company’s total sales revenue. However, certain factors such as being a Business-to-Consumer (B2C) company, a start-up, or operating in a highly competitive market can cause this cost to be on the higher end of that range. There are exceptions to this rule, though. I have personally worked with a company that met all three criteria and was spending over 60% of their sales on marketing. A simple CLV calculation for this company clearly showed that such high spending was not sustainable in the long run.

To accurately calculate CLV, it is ideal to find the NPV of CAC. Discounting CAC reflects its value at the time of acquisition, ensuring the CLV calculation accounts for the time value of money and maintains consistency with discounted revenue streams.

It may be simpler to calculate the total cost of acquisition without considering discounts, but it sacrifices accuracy. For a more precise calculation, identify all expenses related to acquisition, note when they occurred, apply a discount rate to each expense to standardize them to a common date (usually the last day of the transaction log you’re analyzing), and then add them together.

Calculating CLV

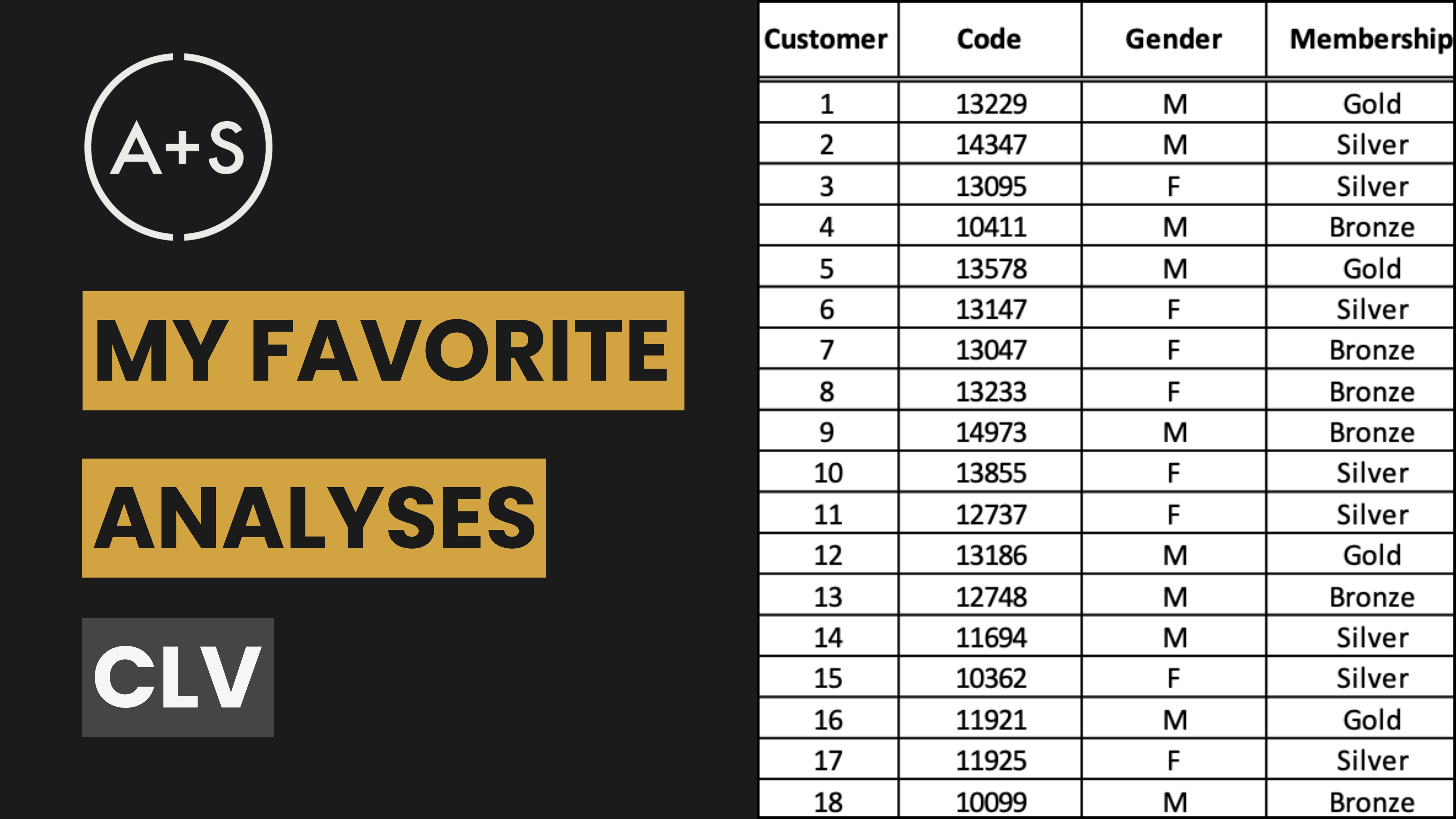

To help you calculate CLV, our analytics consulting firm Nore Analysts has created an R script called “clv_analysis.R” (accessible here). The file is “read only”, but you can download a copy of it for yourself and use it freely. We have included also a sample transaction log titled “tlog_example.csv” (available here) that works with the script. The sample data is limited, containing only 100 transactions from a few customers. However, it will provide a understanding of the data format that the script expects.

The R script uses the BTYD and BTYDplus package to estimate CLV. The BTYD (Buy ‘Til You Die) approach was a collaborative effort between Peter S. Fader, Bruce G.S. Hardie, and Ka Lok Lee. Their groundbreaking paper, “Counting Your Customers the Easy Way: An Alternative to the Pareto/NBD Model,” was published in Marketing Science in 2005. This method models the number of transactions conducted by customers and the probability of their continued activity.

The BTYDplus package was created by Moritz Steiner, Andreas Niekler, and Andreas Martin as an extension of the original BTYD package. It builds on the foundational BTYD models and adds more functionalities and enhancements, making it more versatile and user-friendly for advanced customer behavior analysis.

It’s important to note that the Pareto/NBD (Negative Binomial Distribution) model, used in the R script we are sharing, is most effective in non-contractual or “discrete” business settings where customer churn timing is uncertain. Such settings typically involve infrequent purchases without a formal agreement or subscription, as seen in retail or e-commerce. This presents unique challenges for calculating CLV, compared to subscription-based businesses. We’ve begun with this complex approach to CLV, but will explore subscription-based businesses in future newsletters.

Steps to Using the Nore Analytics R Script

Use the provided R script to calculate CAC, HV, RLV, PAV, and CLV from any basic transaction log.

1. Prepare Your Data:

-

Make sure that your transaction data has columns for the date of the transaction (date), a distinct customer identifier (custID), an exclusive transaction identifier (orderID), and the gross profit generated from each transaction (GM_dollar).

-

Note that your transaction log must have these exact column names, but they can be in any order you’d like.

2. Load the Data:

-

Utilize your own dataset or the provided “tlog_example.csv” to import and prepare your transaction data, ensuring that all dates are correctly formatted and any required calculations are properly set up.

3. Incorporate Marketing Costs and Discount Rate:

-

The program will ask for the total marketing expenses over the analysis period (i.e., the time timespan of your tlog) and use that number to calculate the CAC by dividing it by the total number of customers acquired in your data.

-

As discussed above, ideally the total marketing cost you input is the aggregated NPV of all individual expenses incurred to acquire new customers over the span of the transaction log.

-

Calculate your NPV of CAC to discount costs to the final day of the transaction log, which is when all profits will also be discounted in the script.

-

Additionally, the program will ask for a discount rate, usually a company’s Weighted Average Cost of Capital (WACC), that should be consistent with whatever rate you used to discount CAC.

-

This rate is used to calculate the NPV of past and future profits to the last day of the transaction log.

4. Estimate Model Parameters:

-

The program utilizes the BG/NBD model to make projections on future transactions.

-

This involves analyzing your past transaction data and applying the model to forecast future behavior.

5. Calculate Key Metrics:

-

The script will calculate all the key components of CLV.

-

Historical Value (HV): Discount past transactions to their present value.

-

Residual Lifetime Value (RLV): Discount future predicted transactions to their present value.

-

Post-Acquisition Value (PAV): Sum HV and RLV to get the total customer value before deducting acquisition costs.

6. Compute CLV:

-

The final step of the script involves subtracting the CAC from the PAV, resulting in a complete understanding of each customer’s worth.

Wrapping Up

By utilizing Customer Lifetime Value (CLV) calculations, businesses can make informed decisions on how to effectively allocate resources for customer acquisition and retention. Accurately determining CLV allows companies to prioritize their most valuable customers, optimize marketing strategies, and ultimately drive sustainable growth.

Dissecting CLV into its core components — HV, RLV, PAV, and CAC — businesses can comprehend the past, present, and future value their customers bring. This all-encompassing approach enables better informed decisions about customer acquisition and retention, ultimately fostering sustainable growth and long-term success.

With the provided R script and sample dataset, you can begin calculating CLV for your own business, gaining valuable insights into the past, present, and future value of your customers. This comprehensive approach to CLV provides a deeper understanding of the impact of marketing efforts and guides strategic decisions to increase profitability and improve customer relationships. We encourage you to delve into this analysis and discover how it can revolutionize your approach to customer management and business growth.